SAN JOSE, Calif., May 17, 2023 --

News Summary:

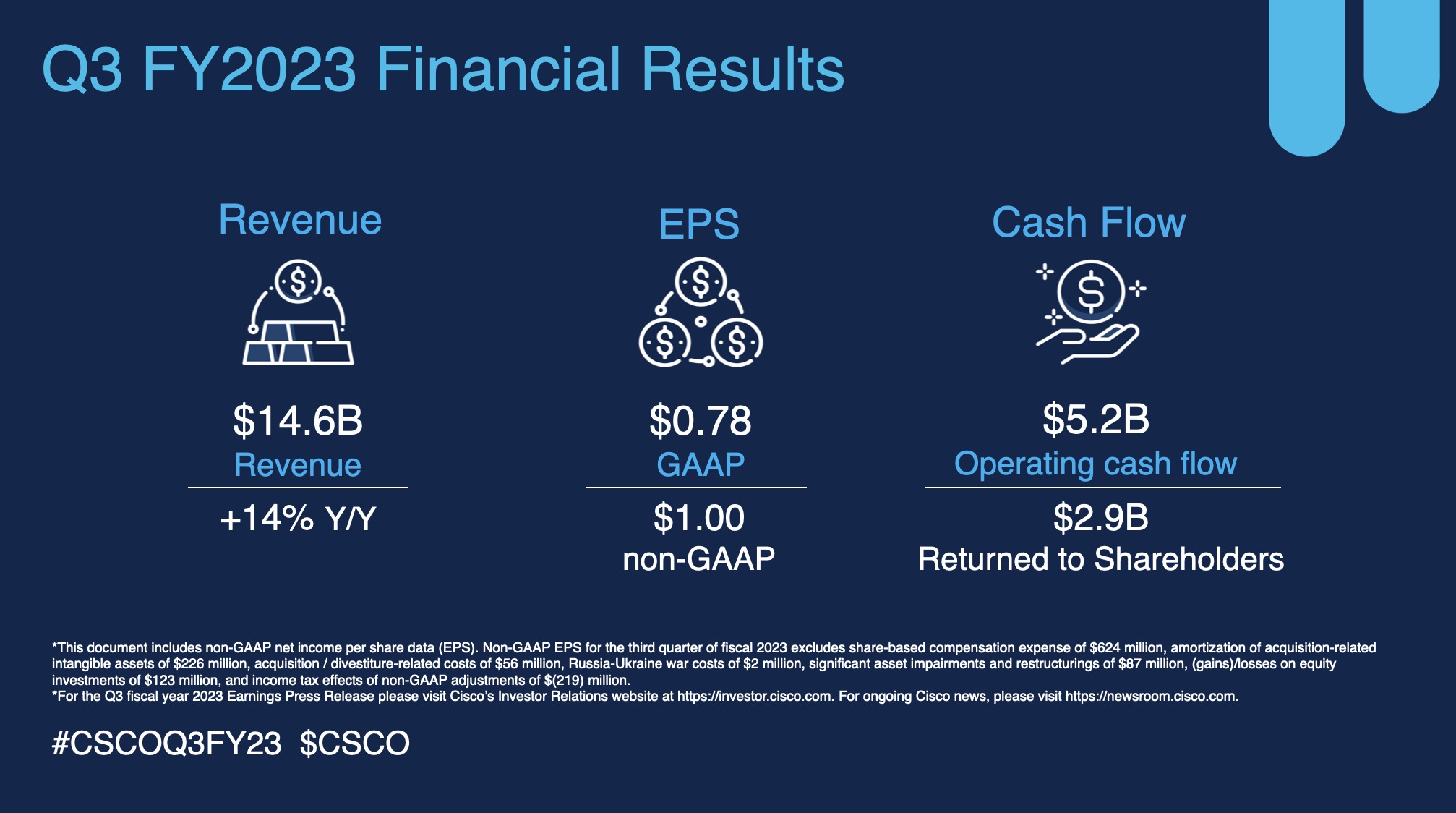

- $14.6 billion in revenue, up 14% year over year; GAAP EPS $0.78, up 7% year over year, and Non-GAAP EPS $1.00, up 15% year over year

- Q3 FY 2023 operating cash flow of $5.2 billion, up 43%

- Continued progress on business model transformation:

- Total software revenue up 18% year over year and software subscription revenue up 17% year over year

- Total annualized recurring revenue (ARR) at $23.8 billion, up 6% year over year and product ARR up 10% year over year

- Remaining performance obligations (RPO) at $32.1 billion, up 6% year over year and product RPO up 9% year over year

- Q3 FY 2023 Results:

- Revenue: $14.6 billion

- Increase of 14% year over year

- Earnings per Share: GAAP: $0.78; Non-GAAP: $1.00

- GAAP EPS increased 7% year over year

- Non-GAAP EPS increased 15% year over year

- Revenue: $14.6 billion

- Q4 FY 2023 Guidance:

- Revenue: 14% to 16% growth year over year

- Earnings per Share: GAAP: $0.82 to $0.87; Non-GAAP: $1.05 to $1.07

- FY 2023 Guidance:

- Revenue: 10% to 10.5% growth year over year

- Earnings per Share: GAAP: $2.93 to $2.98; Non-GAAP: $3.80 to $3.82

Cisco today reported third quarter results for the period ended April 29, 2023. Cisco reported third quarter revenue of $14.6 billion, net income on a generally accepted accounting principles (GAAP) basis of $3.2 billion or $0.78 per share, and non-GAAP net income of $4.1 billion or $1.00 per share.

"We once again delivered a strong quarter in a dynamic environment," said Chuck Robbins, chair and CEO of Cisco. "In Q3, we delivered record revenue and double-digit growth in both software and subscription revenue. As key technologies like cloud, AI and security continue to scale, Cisco's long-established leadership in networking, and the breadth of our portfolio position us well for the future."

"Our operational discipline and focused execution resulted in strong top and bottom-line growth, margin expansion and record operating cash flow," said Scott Herren, CFO of Cisco. "Our healthy backlog, recurring revenue streams and RPO, as well as the improving availability of supply, underpin our confidence to increase full year guidance."

|

GAAP Results |

||||||||

|

Q3 FY 2023 |

Q3 FY 2022 |

Vs. Q3 FY 2022 |

||||||

|

Revenue |

$ |

14.6 billion |

$ |

12.8 billion |

14 % |

|||

|

Net Income |

$ |

3.2 billion |

$ |

3.0 billion |

6 % |

|||

|

Diluted Earnings per Share (EPS) |

$ |

0.78 |

$ |

0.73 |

7 % |

|||

|

Non-GAAP Results |

||||||||

|

Q3 FY 2023 |

Q3 FY 2022 |

Vs. Q3 FY 2022 |

||||||

|

Net Income |

$ |

4.1 billion |

$ |

3.6 billion |

13 % |

|||

|

EPS |

$ |

1.00 |

$ |

0.87 |

15 % |

|||

Reconciliations between net income, EPS, and other measures on a GAAP and non-GAAP basis are provided in the tables located in the section entitled "Reconciliations of GAAP to non-GAAP Measures."

Cisco Declares Quarterly Dividend

Cisco has declared a quarterly dividend of $0.39 per common share to be paid on July 26, 2023, to all stockholders of record as of the close of business on July 6, 2023. Future dividends will be subject to Board approval.

Financial Summary

All comparative percentages are on a year-over-year basis unless otherwise noted.

Q3 FY 2023 Highlights

Revenue -- Total revenue was up 14% at $14.6 billion, with product revenue up 17% and service revenue was up 3%. Revenue by geographic segment was: Americas up 13%, EMEA up 16%, and APJC was up 11%. Product revenue performance was led by growth in Secure, Agile Networks up 29%, Internet for the Future up 5%, End-to-End Security up 2%, and Optimized Application Experiences up 12%. Collaboration was down 13%.

Gross Margin -- On a GAAP basis, total gross margin, product gross margin, and service gross margin were 63.4%, 62.7%, and 65.4%, respectively, as compared with 63.3%, 61.8%, and 67.3%, respectively, in the third quarter of fiscal 2022.

On a non-GAAP basis, total gross margin, product gross margin, and service gross margin were 65.2%, 64.5%, and 67.3%, respectively, as compared with 65.3%, 64.1%, and 68.9%, respectively, in the third quarter of fiscal 2022.

Total gross margins by geographic segment were: 64.2% for the Americas, 66.6% for EMEA and 66.4% for APJC.

Operating Expenses -- On a GAAP basis, operating expenses were $5.3 billion, up 17%, and were 36.3% of revenue. Non-GAAP operating expenses were $4.6 billion, up 16%, and were 31.3% of revenue.

Operating Income -- GAAP operating income was $3.9 billion, up 9%, with GAAP operating margin of 27.1%. Non-GAAP operating income was $4.9 billion, up 11%, with non-GAAP operating margin at 33.9%.

Provision for Income Taxes -- The GAAP tax provision rate was 18.8%. The non-GAAP tax provision rate was 19.0%.

Net Income and EPS -- On a GAAP basis, net income was $3.2 billion, an increase of 6%, and EPS was $0.78, an increase of 7%. On a non-GAAP basis, net income was $4.1 billion, an increase of 13%, and EPS was $1.00, an increase of 15%.

Cash Flow from Operating Activities -- $5.2 billion for the third quarter of fiscal 2023, an increase of 43% compared with $3.7 billion for the third quarter of fiscal 2022.

Balance Sheet and Other Financial Highlights

Cash and Cash Equivalents and Investments -- $23.3 billion at the end of the third quarter of fiscal 2023, compared with $19.3 billion at the end of fiscal 2022.

Remaining Performance Obligations (RPO) -- $32.1 billion, up 6% in total, with 53% of this amount to be recognized as revenue over the next 12 months. Product RPO were up 9% and service RPO were up 4%.

Deferred Revenue -- $24.3 billion, up 9% in total, with deferred product revenue up 11%. Deferred service revenue was up 7%.

Capital Allocation -- In the third quarter of fiscal 2023, we returned $2.9 billion to stockholders through share buybacks and dividends. We declared and paid a cash dividend of $0.39 per common share, or $1.6 billion, and repurchased approximately 25 million shares of common stock under our stock repurchase program at an average price of $49.45 per share for an aggregate purchase price of $1.3 billion. The remaining authorized amount for stock repurchases under the program is $12.2 billion with no termination date.

Acquisitions

In the third quarter of fiscal 2023, we closed the acquisition of Valtix, a privately held cloud network security company.

Guidance

Cisco expects to achieve the following results for the fourth quarter of fiscal 2023:

|

Q4 FY 2023 |

||

|

Revenue |

14% – 16% growth Y/Y |

|

|

Non-GAAP gross margin rate |

64.5% – 65.5% |

|

|

Non-GAAP operating margin rate |

34% – 35% |

|

|

Non-GAAP EPS |

$1.05 – $1.07 |

Cisco estimates that GAAP EPS will be $0.82 to $0.87 for the fourth quarter of fiscal 2023.

Cisco expects to achieve the following results for fiscal 2023:

|

FY 2023 |

||

|

Revenue |

10% – 10.5% growth Y/Y |

|

|

Non-GAAP EPS |

$3.80 – $3.82 |

Cisco estimates that GAAP EPS will be $2.93 to $2.98 for fiscal 2023.

Our Q4 FY 2023 guidance assumes an effective tax provision rate of 18% for GAAP and 19% for non-GAAP results. Our FY 2023 guidance assumes an effective tax provision rate of 20% for GAAP and 19% for non-GAAP results.

A reconciliation between the Guidance on a GAAP and non-GAAP basis is provided in the tables entitled "GAAP to non-GAAP Guidance" located in the section entitled "Reconciliations of GAAP to non-GAAP Measures."

Editor's Notes:

- Q3 fiscal year 2023 conference call to discuss Cisco's results along with its guidance will be held on Wednesday, May 17, 2023 at 1:30 p.m. Pacific Time. Conference call number is 1-888-848-6507 (United States) or 1-212-519-0847 (international).

- Conference call replay will be available from 4:00 p.m. Pacific Time, May 17, 2023 to 4:00 p.m. Pacific Time, May 24, 2023 at 1-800-395-6236 (United States) or 1-203-369-3270 (international). The replay will also be available via webcast on the Cisco Investor Relations website at https://investor.cisco.com.

- Additional information regarding Cisco's financials, as well as a webcast of the conference call with visuals designed to guide participants through the call, will be available at 1:30 p.m. Pacific Time, May 17, 2023. Text of the conference call's prepared remarks will be available within 24 hours of completion of the call. The webcast will include both the prepared remarks and the question-and-answer session. This information, along with the GAAP to non-GAAP reconciliation information, will be available on the Cisco Investor Relations website at https://investor.cisco.com.

|

CISCO SYSTEMS, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per-share amounts) (Unaudited) |

|||||||

|

Three Months Ended |

Nine Months Ended |

||||||

|

April 29, 2023 |

April 30, 2022 |

April 29, 2023 |

April 30, 2022 |

||||

|

REVENUE: |

|||||||

|

Product |

$ 11,092 |

$ 9,448 |

$ 31,492 |

$ 28,330 |

|||

|

Service |

3,479 |

3,387 |

10,303 |

10,125 |

|||

|

Total revenue |

14,571 |

12,835 |

41,795 |

38,455 |

|||

|

COST OF SALES: |

|||||||

|

Product |

4,136 |

3,606 |

12,353 |

10,848 |

|||

|

Service |

1,203 |

1,108 |

3,437 |

3,384 |

|||

|

Total cost of sales |

5,339 |

4,714 |

15,790 |

14,232 |

|||

|

GROSS MARGIN |

9,232 |

8,121 |

26,005 |

24,223 |

|||

|

OPERATING EXPENSES: |

|||||||

|

Research and development |

1,962 |

1,708 |

5,598 |

5,092 |

|||

|

Sales and marketing |

2,526 |

2,209 |

7,301 |

6,736 |

|||

|

General and administrative |

641 |

517 |

1,788 |

1,612 |

|||

|

Amortization of purchased intangible assets |

70 |

77 |

212 |

240 |

|||

|

Restructuring and other charges |

87 |

— |

328 |

8 |

|||

|

Total operating expenses |

5,286 |

4,511 |

15,227 |

13,688 |

|||

|

OPERATING INCOME |

3,946 |

3,610 |

10,778 |

10,535 |

|||

|

Interest income |

262 |

115 |

650 |

347 |

|||

|

Interest expense |

(109) |

(90) |

(316) |

(267) |

|||

|

Other income (loss), net |

(142) |

166 |

(265) |

446 |

|||

|

Interest and other income (loss), net |

11 |

191 |

69 |

526 |

|||

|

INCOME BEFORE PROVISION FOR INCOME TAXES |

3,957 |

3,801 |

10,847 |

11,061 |

|||

|

Provision for income taxes |

745 |

757 |

2,192 |

2,064 |

|||

|

NET INCOME |

$ 3,212 |

$ 3,044 |

$ 8,655 |

$ 8,997 |

|||

|

Net income per share: |

|||||||

|

Basic |

$ 0.79 |

$ 0.73 |

$ 2.11 |

$ 2.15 |

|||

|

Diluted |

$ 0.78 |

$ 0.73 |

$ 2.11 |

$ 2.14 |

|||

|

Shares used in per-share calculation: |

|||||||

|

Basic |

4,089 |

4,152 |

4,100 |

4,184 |

|||

|

Diluted |

4,110 |

4,170 |

4,111 |

4,204 |

|||

|

CISCO SYSTEMS, INC. REVENUE BY SEGMENT (In millions, except percentages) |

||||||||

|

April 29, 2023 |

||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||

|

Amount |

Y/Y % |

Amount |

Y/Y % |

|||||

|

Revenue : |

||||||||

|

Americas |

$ 8,634 |

13 % |

$ 24,372 |

9 % |

||||

|

EMEA |

3,806 |

16 % |

11,209 |

11 % |

||||

|

APJC |

2,131 |

11 % |

6,214 |

4 % |

||||

|

Total |

$ 14,571 |

14 % |

$ 41,795 |

9 % |

||||

|

Amounts may not sum and percentages may not recalculate due to rounding. |

|

CISCO SYSTEMS, INC. GROSS MARGIN PERCENTAGE BY SEGMENT (In percentages) |

||||

|

April 29, 2023 |

||||

|

Three Months Ended |

Nine Months Ended |

|||

|

Gross Margin Percentage : |

||||

|

Americas |

64.2 % |

63.4 % |

||

|

EMEA |

66.6 % |

65.4 % |

||

|

APJC |

66.4 % |

64.2 % |

||

|

CISCO SYSTEMS, INC. REVENUE FOR GROUPS OF SIMILAR PRODUCTS AND SERVICES (In millions, except percentages) |

||||||||

|

April 29, 2023 |

||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||

|

Amount |

Y/Y % |

Amount |

Y/Y % |

|||||

|

Revenue : |

||||||||

|

Secure, Agile Networks |

$ 7,550 |

29 % |

$ 20,980 |

18 % |

||||

|

Internet for the Future |

1,392 |

5 % |

4,007 |

— % |

||||

|

Collaboration |

985 |

(13) % |

3,029 |

(8) % |

||||

|

End-to-End Security |

958 |

2 % |

2,872 |

6 % |

||||

|

Optimized Application Experiences |

204 |

12 % |

597 |

10 % |

||||

|

Other Products |

3 |

19 % |

7 |

(7) % |

||||

|

Total Product |

11,092 |

17 % |

31,492 |

11 % |

||||

|

Services |

3,479 |

3 % |

10,303 |

2 % |

||||

|

Total |

$ 14,571 |

14 % |

$ 41,795 |

9 % |

||||

|

Amounts may not sum and percentages may not recalculate due to rounding. |

|

CISCO SYSTEMS, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In millions) (Unaudited) |

|||

|

April 29, 2023 |

July 30, 2022 |

||

|

ASSETS |

|||

|

Current assets: |

|||

|

Cash and cash equivalents |

$ 8,044 |

$ 7,079 |

|

|

Investments |

15,244 |

12,188 |

|

|

Accounts receivable, net of allowance of $83 as of each of April 29, 2023 and July 30, 2022 |

5,104 |

6,622 |

|

|

Inventories |

3,474 |

2,568 |

|

|

Financing receivables, net |

3,402 |

3,905 |

|

|

Other current assets |

4,682 |

4,355 |

|

|

Total current assets |

39,950 |

36,717 |

|

|

Property and equipment, net |

2,047 |

1,997 |

|

|

Financing receivables, net |

3,393 |

4,009 |

|

|

Goodwill |

38,369 |

38,304 |

|

|

Purchased intangible assets, net |

1,966 |

2,569 |

|

|

Deferred tax assets |

5,817 |

4,449 |

|

|

Other assets |

5,987 |

5,957 |

|

|

TOTAL ASSETS |

$ 97,529 |

$ 94,002 |

|

|

LIABILITIES AND EQUITY |

|||

|

Current liabilities: |

|||

|

Short-term debt |

$ 1,731 |

$ 1,099 |

|

|

Accounts payable |

2,442 |

2,281 |

|

|

Income taxes payable |

3,132 |

961 |

|

|

Accrued compensation |

3,352 |

3,316 |

|

|

Deferred revenue |

13,249 |

12,784 |

|

|

Other current liabilities |

4,813 |

5,199 |

|

|

Total current liabilities |

28,719 |

25,640 |

|

|

Long-term debt |

6,663 |

8,416 |

|

|

Income taxes payable |

6,725 |

7,725 |

|

|

Deferred revenue |

11,011 |

10,480 |

|

|

Other long-term liabilities |

2,116 |

1,968 |

|

|

Total liabilities |

55,234 |

54,229 |

|

|

Total equity |

42,295 |

39,773 |

|

|

TOTAL LIABILITIES AND EQUITY |

$ 97,529 |

$ 94,002 |

|

|

CISCO SYSTEMS, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) (Unaudited) |

|||

|

Nine Months Ended |

|||

|

April 29, |

April 30, |

||

|

Cash flows from operating activities: |

|||

|

Net income |

$ 8,655 |

$ 8,997 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|||

|

Depreciation, amortization, and other |

1,304 |

1,527 |

|

|

Share-based compensation expense |

1,720 |

1,407 |

|

|

Provision (benefit) for receivables |

11 |

49 |

|

|

Deferred income taxes |

(1,343) |

(167) |

|

|

(Gains) losses on divestitures, investments and other, net |

243 |

(470) |

|

|

Change in operating assets and liabilities, net of effects of acquisitions and divestitures: |

|||

|

Accounts receivable |

1,494 |

(134) |

|

|

Inventories |

(894) |

(683) |

|

|

Financing receivables |

1,126 |

1,431 |

|

|

Other assets |

(428) |

(1,295) |

|

|

Accounts payable |

156 |

(54) |

|

|

Income taxes, net |

1,120 |

(730) |

|

|

Accrued compensation |

25 |

(730) |

|

|

Deferred revenue |

1,055 |

292 |

|

|

Other liabilities |

(324) |

109 |

|

|

Net cash provided by operating activities |

13,920 |

9,549 |

|

|

Cash flows from investing activities: |

|||

|

Purchases of investments |

(7,652) |

(5,383) |

|

|

Proceeds from sales of investments |

802 |

2,488 |

|

|

Proceeds from maturities of investments |

3,789 |

4,308 |

|

|

Acquisitions, net of cash and cash equivalents acquired and divestitures |

(96) |

(373) |

|

|

Purchases of investments in privately held companies |

(162) |

(158) |

|

|

Return of investments in privately held companies |

72 |

149 |

|

|

Acquisition of property and equipment |

(616) |

(338) |

|

|

Proceeds from sales of property and equipment |

2 |

6 |

|

|

Other |

(26) |

(15) |

|

|

Net cash (used in) provided by investing activities |

(3,887) |

684 |

|

|

Cash flows from financing activities: |

|||

|

Issuances of common stock |

316 |

306 |

|

|

Repurchases of common stock - repurchase program |

(3,029) |

(5,347) |

|

|

Shares repurchased for tax withholdings on vesting of restricted stock units |

(444) |

(546) |

|

|

Short-term borrowings, original maturities of 90 days or less, net |

(602) |

9 |

|

|

Issuances of debt |

— |

1,049 |

|

|

Repayments of debt |

(500) |

(3,050) |

|

|

Dividends paid |

(4,713) |

(4,657) |

|

|

Other |

(4) |

(108) |

|

|

Net cash used in financing activities |

(8,976) |

(12,344) |

|

|

Effect of foreign currency exchange rate changes on cash, cash equivalents, restricted cash and restricted cash equivalents |

(90) |

(122) |

|

|

Net increase (decrease) in cash, cash equivalents, restricted cash and restricted cash equivalents |

967 |

(2,233) |

|

|

Cash, cash equivalents, restricted cash and restricted cash equivalents, beginning of period |

8,579 |

9,942 |

|

|

Cash, cash equivalents, restricted cash and restricted cash equivalents, end of period |

$ 9,546 |

$ 7,709 |

|

|

Supplemental cash flow information: |

|||

|

Cash paid for interest |

$ 306 |

$ 292 |

|

|

Cash paid for income taxes, net |

$ 2,414 |

$ 2,960 |

|

|

CISCO SYSTEMS, INC. REMAINING PERFORMANCE OBLIGATIONS (In millions, except percentages) |

|||||||||||

|

April 29, 2023 |

January 28, 2023 |

April 30, 2022 |

|||||||||

|

Amount |

Y/Y% |

Amount |

Y/Y% |

Amount |

Y/Y% |

||||||

|

Product |

$ 14,681 |

9 % |

$ 14,517 |

7 % |

$ 13,416 |

13 % |

|||||

|

Service |

17,401 |

4 % |

17,255 |

2 % |

16,789 |

3 % |

|||||

|

Total |

$ 32,082 |

6 % |

$ 31,772 |

4 % |

$ 30,205 |

7 % |

|||||

|

We expect 53% of total RPO at April 29, 2023 will be recognized as revenue over the next 12 months. |

|

CISCO SYSTEMS, INC. DEFERRED REVENUE (In millions) |

|||||

|

April 29, 2023 |

January 28, 2023 |

April 30, 2022 |

|||

|

Deferred revenue: |

|||||

|

Product |

$ 10,895 |

$ 10,679 |

$ 9,835 |

||

|

Service |

13,365 |

13,248 |

12,458 |

||

|

Total |

$ 24,260 |

$ 23,927 |

$ 22,293 |

||

|

Reported as: |

|||||

|

Current |

$ 13,249 |

$ 13,109 |

$ 12,249 |

||

|

Noncurrent |

11,011 |

10,818 |

10,044 |

||

|

Total |

$ 24,260 |

$ 23,927 |

$ 22,293 |

||

|

CISCO SYSTEMS, INC. DIVIDENDS PAID AND REPURCHASES OF COMMON STOCK (In millions, except per-share amounts) |

||||||||||||

|

DIVIDENDS |

STOCK REPURCHASE PROGRAM |

TOTAL |

||||||||||

|

Quarter Ended |

Per Share |

Amount |

Shares |

Weighted- |

Amount |

Amount |

||||||

|

Fiscal 2023 |

||||||||||||

|

April 29, 2023 |

$ 0.39 |

$ 1,593 |

25 |

$ 49.45 |

$ 1,259 |

$ 2,852 |

||||||

|

January 28, 2023 |

$ 0.38 |

$ 1,560 |

26 |

$ 47.72 |

$ 1,256 |

$ 2,816 |

||||||

|

October 29, 2022 |

$ 0.38 |

$ 1,560 |

12 |

$ 43.76 |

$ 502 |

$ 2,062 |

||||||

|

Fiscal 2022 |

||||||||||||

|

July 30, 2022 |

$ 0.38 |

$ 1,567 |

54 |

$ 44.02 |

$ 2,402 |

$ 3,969 |

||||||

|

April 30, 2022 |

$ 0.38 |

$ 1,555 |

5 |

$ 54.20 |

$ 252 |

$ 1,807 |

||||||

|

January 29, 2022 |

$ 0.37 |

$ 1,541 |

82 |

$ 58.36 |

$ 4,824 |

$ 6,365 |

||||||

|

October 30, 2021 |

$ 0.37 |

$ 1,561 |

5 |

$ 56.49 |

$ 256 |

$ 1,817 |

||||||

|

CISCO SYSTEMS, INC. RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES |

|||||||

|

GAAP TO NON-GAAP NET INCOME (In millions) |

|||||||

|

Three Months Ended |

Nine Months Ended |

||||||

|

April 29, |

April 30, |

April 29, |

April 30, |

||||

|

GAAP net income |

$ 3,212 |

$ 3,044 |

$ 8,655 |

$ 8,997 |

|||

|

Adjustments to cost of sales: |

|||||||

|

Share-based compensation expense |

106 |

83 |

293 |

233 |

|||

|

Amortization of acquisition-related intangible assets |

156 |

176 |

462 |

571 |

|||

|

Acquisition-related/divestiture costs |

1 |

1 |

4 |

3 |

|||

|

Russia-Ukraine war costs |

— |

5 |

— |

5 |

|||

|

Total adjustments to GAAP cost of sales |

263 |

265 |

759 |

812 |

|||

|

Adjustments to operating expenses: |

|||||||

|

Share-based compensation expense |

518 |

394 |

1,431 |

1,173 |

|||

|

Amortization of acquisition-related intangible assets |

70 |

92 |

212 |

255 |

|||

|

Acquisition-related/divestiture costs |

55 |

29 |

178 |

261 |

|||

|

Russia-Ukraine war costs |

2 |

62 |

7 |

62 |

|||

|

Significant asset impairments and restructurings |

87 |

— |

328 |

8 |

|||

|

Total adjustments to GAAP operating expenses |

732 |

577 |

2,156 |

1,759 |

|||

|

Adjustments to interest and other income (loss), net: |

|||||||

|

(Gains) and losses on investments |

123 |

(159) |

188 |

(478) |

|||

|

Total adjustments to GAAP interest and other income (loss), net |

123 |

(159) |

188 |

(478) |

|||

|

Total adjustments to GAAP income before provision for income taxes |

1,118 |

683 |

3,103 |

2,093 |

|||

|

Income tax effect of non-GAAP adjustments |

(219) |

(95) |

(623) |

(435) |

|||

|

Significant tax matters |

— |

— |

164 |

— |

|||

|

Total adjustments to GAAP provision for income taxes |

(219) |

(95) |

(459) |

(435) |

|||

|

Non-GAAP net income |

$ 4,111 |

$ 3,632 |

$ 11,299 |

$ 10,655 |

|||

|

CISCO SYSTEMS, INC. RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES |

|||||||

|

GAAP TO NON-GAAP EPS |

|||||||

|

Three Months Ended |

Nine Months Ended |

||||||

|

April 29, |

April 30, |

April 29, |

April 30, |

||||

|

GAAP EPS |

$ 0.78 |

$ 0.73 |

$ 2.11 |

$ 2.14 |

|||

|

Adjustments to GAAP: |

|||||||

|

Share-based compensation expense |

0.15 |

0.11 |

0.42 |

0.33 |

|||

|

Amortization of acquisition-related intangible assets |

0.06 |

0.06 |

0.16 |

0.20 |

|||

|

Acquisition-related/divestiture costs |

0.01 |

0.01 |

0.04 |

0.06 |

|||

|

Russia-Ukraine war costs |

— |

0.02 |

— |

0.02 |

|||

|

Significant asset impairments and restructurings |

0.02 |

— |

0.08 |

— |

|||

|

(Gains) and losses on investments |

0.03 |

(0.04) |

0.05 |

(0.11) |

|||

|

Income tax effect of non-GAAP adjustments |

(0.05) |

(0.02) |

(0.15) |

(0.10) |

|||

|

Significant tax matters |

— |

— |

0.04 |

— |

|||

|

Non-GAAP EPS |

$ 1.00 |

$ 0.87 |

$ 2.75 |

$ 2.53 |

|||

|

Amounts may not sum due to rounding. |

|

CISCO SYSTEMS, INC. RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES |

|||||||||||||||||||

|

GROSS MARGINS, OPERATING EXPENSES, OPERATING MARGINS, INTEREST AND OTHER INCOME (LOSS), NET, (In millions, except percentages) |

|||||||||||||||||||

|

Three Months Ended |

|||||||||||||||||||

|

April 29, 2023 |

|||||||||||||||||||

|

Product |

Service |

Total |

Operating |

Y/Y |

Operating |

Y/Y |

Interest |

Net Income |

Y/Y |

||||||||||

|

GAAP amount |

$ 6,956 |

$ 2,276 |

$ 9,232 |

$ 5,286 |

17 % |

$ 3,946 |

9 % |

$ 11 |

$ 3,212 |

6 % |

|||||||||

|

% of revenue |

62.7 % |

65.4 % |

63.4 % |

36.3 % |

27.1 % |

0.1 % |

22.0 % |

||||||||||||

|

Adjustments to GAAP amounts: |

|||||||||||||||||||

|

Share-based compensation expense |

40 |

66 |

106 |

518 |

624 |

— |

624 |

||||||||||||

|

Amortization of acquisition-related intangible assets |

156 |

— |

156 |

70 |

226 |

— |

226 |

||||||||||||

|

Acquisition/divestiture-related costs |

1 |

— |

1 |

55 |

56 |

— |

56 |

||||||||||||

|

Significant asset impairments and restructurings |

— |

— |

— |

87 |

87 |

— |

87 |

||||||||||||

|

Russia-Ukraine war costs |

— |

— |

— |

2 |

2 |

— |

2 |

||||||||||||

|

(Gains) and losses on investments |

— |

— |

— |

— |

— |

123 |

123 |

||||||||||||

|

Income tax effect/significant tax matters |

— |

— |

— |

— |

— |

— |

(219) |

||||||||||||

|

Non-GAAP amount |

$ 7,153 |

$ 2,342 |

$ 9,495 |

$ 4,554 |

16 % |

$ 4,941 |

11 % |

$ 134 |

$ 4,111 |

13 % |

|||||||||

|

% of revenue |

64.5 % |

67.3 % |

65.2 % |

31.3 % |

33.9 % |

0.9 % |

28.2 % |

||||||||||||

|

Three Months Ended |

|||||||||||||

|

April 30, 2022 |

|||||||||||||

|

Product |

Service |

Total |

Operating |

Operating Income |

Interest |

Net Income |

|||||||

|

GAAP amount |

$ 5,842 |

$ 2,279 |

$ 8,121 |

$ 4,511 |

$ 3,610 |

$ 191 |

$ 3,044 |

||||||

|

% of revenue |

61.8 % |

67.3 % |

63.3 % |

35.1 % |

28.1 % |

1.5 % |

23.7 % |

||||||

|

Adjustments to GAAP amounts: |

|||||||||||||

|

Share-based compensation expense |

30 |

53 |

83 |

394 |

477 |

— |

477 |

||||||

|

Amortization of acquisition-related intangible assets |

176 |

— |

176 |

92 |

268 |

— |

268 |

||||||

|

Acquisition/divestiture-related costs |

1 |

— |

1 |

29 |

30 |

— |

30 |

||||||

|

Russia-Ukraine war costs |

4 |

1 |

5 |

62 |

67 |

— |

67 |

||||||

|

(Gains) and losses on investments |

— |

— |

— |

— |

— |

(159) |

(159) |

||||||

|

Income tax effect/significant tax matters |

— |

— |

— |

— |

— |

— |

(95) |

||||||

|

Non-GAAP amount |

$ 6,053 |

$ 2,333 |

$ 8,386 |

$ 3,934 |

$ 4,452 |

$ 32 |

$ 3,632 |

||||||

|

% of revenue |

64.1 % |

68.9 % |

65.3 % |

30.7 % |

34.7 % |

0.2 % |

28.3 % |

||||||

|

Amounts may not sum and percentages may not recalculate due to rounding. |

|

CISCO SYSTEMS, INC. RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES |

|||||||||||||||||||

|

GROSS MARGINS, OPERATING EXPENSES, OPERATING MARGINS, INTEREST AND OTHER INCOME (LOSS), NET, (In millions, except percentages) |

|||||||||||||||||||

|

Nine Months Ended |

|||||||||||||||||||

|

April 29, 2023 |

|||||||||||||||||||

|

Product |

Service |

Total |

Operating |

Y/Y |

Operating |

Y/Y |

Interest |

Net Income |

Y/Y |

||||||||||

|

GAAP amount |

$ 19,139 |

$ 6,866 |

$ 26,005 |

$ 15,227 |

11 % |

$ 10,778 |

2 % |

$ 69 |

$ 8,655 |

(4) % |

|||||||||

|

% of revenue |

60.8 % |

66.6 % |

62.2 % |

36.4 % |

25.8 % |

0.2 % |

20.7 % |

||||||||||||

|

Adjustments to GAAP amounts: |

|||||||||||||||||||

|

Share-based compensation expense |

111 |

182 |

293 |

1,431 |

1,724 |

— |

1,724 |

||||||||||||

|

Amortization of acquisition-related intangible assets |

462 |

— |

462 |

212 |

674 |

— |

674 |

||||||||||||

|

Acquisition/divestiture-related costs |

4 |

— |

4 |

178 |

182 |

— |

182 |

||||||||||||

|

Significant asset impairments and restructurings |

— |

— |

— |

328 |

328 |

— |

328 |

||||||||||||

|

Russia-Ukraine war costs |

— |

— |

— |

7 |

7 |

— |

7 |

||||||||||||

|

(Gains) and losses on investments |

— |

— |

— |

— |

— |

188 |

188 |

||||||||||||

|

Income tax effect/significant tax matters |

— |

— |

— |

— |

— |

— |

(459) |

||||||||||||

|

Non-GAAP amount |

$ 19,716 |

$ 7,048 |

$ 26,764 |

$ 13,071 |

10 % |

$ 13,693 |

4 % |

$ 257 |

$ 11,299 |

6 % |

|||||||||

|

% of revenue |

62.6 % |

68.4 % |

64.0 % |

31.3 % |

32.8 % |

0.6 % |

27.0 % |

||||||||||||

|

Nine Months Ended |

|||||||||||||

|

April 30, 2022 |

|||||||||||||

|

Product |

Service |

Total |

Operating |

Operating Income |

Interest |

Net Income |

|||||||

|

GAAP amount |

$ 17,482 |

$ 6,741 |

$ 24,223 |

$ 13,688 |

$ 10,535 |

$ 526 |

$ 8,997 |

||||||

|

% of revenue |

61.7 % |

66.6 % |

63.0 % |

35.6 % |

27.4 % |

1.4 % |

23.4 % |

||||||

|

Adjustments to GAAP amounts: |

|||||||||||||

|

Share-based compensation expense |

84 |

149 |

233 |

1,173 |

1,406 |

— |

1,406 |

||||||

|

Amortization of acquisition-related intangible assets |

571 |

— |

571 |

255 |

826 |

— |

826 |

||||||

|

Acquisition/divestiture-related costs |

3 |

— |

3 |

261 |

264 |

— |

264 |

||||||

|

Russia-Ukraine war costs |

4 |

1 |

5 |

62 |

67 |

— |

67 |

||||||

|

Significant asset impairments and restructurings |

— |

— |

— |

8 |

8 |

— |

8 |

||||||

|

(Gains) and losses on investments |

— |

— |

— |

— |

— |

(478) |

(478) |

||||||

|

Income tax effect/significant tax matters |

— |

— |

— |

— |

— |

— |

(435) |

||||||

|

Non-GAAP amount |

$ 18,144 |

$ 6,891 |

$ 25,035 |

$ 11,929 |

$ 13,106 |

$ 48 |

$ 10,655 |

||||||

|

% of revenue |

64.0 % |

68.1 % |

65.1 % |

31.0 % |

34.1 % |

0.1 % |

27.7 % |

||||||

|

Amounts may not sum and percentages may not recalculate due to rounding. |

|

CISCO SYSTEMS, INC. RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES |

|||||||

|

EFFECTIVE TAX RATE (In percentages) |

|||||||

|

Three Months Ended |

Nine Months Ended |

||||||

|

April 29, 2023 |

April 30, 2022 |

April 29, 2023 |

April 30, 2022 |

||||

|

GAAP effective tax rate |

18.8 % |

19.9 % |

20.2 % |

18.7 % |

|||

|

Total adjustments to GAAP provision for income taxes |

0.2 % |

(0.9) % |

(1.2) % |

0.3 % |

|||

|

Non-GAAP effective tax rate |

19.0 % |

19.0 % |

19.0 % |

19.0 % |

|||

|

GAAP TO NON-GAAP GUIDANCE |

||||||

|

Q4 FY 2023 |

Gross Margin |

Operating Margin |

Earnings per |

|||

|

GAAP |

62.5% – 63.5% |

26.5% – 27.5% |

$0.82 – $0.87 |

|||

|

Estimated adjustments for: |

||||||

|

Share-based compensation expense |

1.0 % |

4.0 % |

$0.11 – $0.12 |

|||

|

Amortization of acquisition-related intangible assets and |

1.0 % |

2.0 % |

$0.05 – $0.06 |

|||

|

Significant asset impairments and restructurings (1) |

— |

1.5 % |

$0.04 – $0.05 |

|||

|

Non-GAAP |

64.5% – 65.5% |

34% – 35% |

$1.05 – $1.07 |

|||

|

FY 2023 |

Earnings per |

|

|

GAAP |

$2.93 – $2.98 |

|

|

Estimated adjustments for: |

||

|

Share-based compensation expense |

$0.45 – $0.46 |

|

|

Amortization of acquisition-related intangible assets and |

$0.22 – $0.23 |

|

|

Significant asset impairments and restructurings (1) |

$0.10 – $0.11 |

|

|

(Gains) and losses on investments |

$0.03 |

|

|

Significant tax matters |

$0.04 |

|

|

Non-GAAP |

$3.80 – $3.82 |

|

(1) |

On November 16, 2022, Cisco announced a restructuring plan in order to rebalance the organization and enable further investment in key priority areas. We expect to recognize approximately $200 million of restructuring charges in the fourth quarter of fiscal 2023. |

|

(2) |

Estimated adjustments to GAAP earnings per share are shown after income tax effects. |

Except as noted above, this guidance does not include the effects of any future acquisitions/divestitures, asset impairments, Russia-Ukraine war costs, restructurings, (gains) and losses on investments and significant tax matters or other events, which may or may not be significant unless specifically stated.

Forward Looking Statements, Non-GAAP Information and Additional Information

This release may be deemed to contain forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among other things, statements regarding future events (such as key technologies like cloud, AI and security continuing to scale, our continued leadership in networking, the breadth of our portfolio to position us well for the future, our healthy backlog, recurring revenue streams, RPO and the continued improving availability of supply) and the future financial performance of Cisco (including the guidance for Q4 FY 2023 and full year FY 2023) that involve risks and uncertainties. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual future events or results due to a variety of factors, including: the impact of the COVID-19 pandemic and related public health measures; business and economic conditions and growth trends in the networking industry, our customer markets and various geographic regions; global economic conditions and uncertainties in the geopolitical environment; overall information technology spending; the growth and evolution of the Internet and levels of capital spending on Internet-based systems; variations in customer demand for products and services, including sales to the service provider market and other customer markets; the return on our investments in certain priorities, key growth areas, and in certain geographical locations, as well as maintaining leadership in Secure, Agile Networks and services; the timing of orders and manufacturing and customer lead times; significant supply constraints; changes in customer order patterns or customer mix; insufficient, excess or obsolete inventory; variability of component costs; variations in sales channels, product costs or mix of products sold; our ability to successfully acquire businesses and technologies and to successfully integrate and operate these acquired businesses and technologies; our ability to achieve expected benefits of our partnerships; increased competition in our product and service markets, including the data center market; dependence on the introduction and market acceptance of new product offerings and standards; rapid technological and market change; manufacturing and sourcing risks; product defects and returns; litigation involving patents, other intellectual property, antitrust, stockholder and other matters, and governmental investigations; our ability to achieve the benefits of restructurings and possible changes in the size and timing of related charges; cyber-attacks, data breaches or malware; vulnerabilities and critical security defects; terrorism; natural catastrophic events (including as a result of global climate change); any other pandemic or epidemic; our ability to achieve the benefits anticipated from our investments in sales, engineering, service, marketing and manufacturing activities; our ability to recruit and retain key personnel; our ability to manage financial risk, and to manage expenses during economic downturns; risks related to the global nature of our operations, including our operations in emerging markets; currency fluctuations and other international factors; changes in provision for income taxes, including changes in tax laws and regulations or adverse outcomes resulting from examinations of our income tax returns; potential volatility in operating results; and other factors listed in Cisco's most recent reports on Forms 10-Q and 10-K filed on February 21, 2023 and September 8, 2022, respectively. The financial information contained in this release should be read in conjunction with the consolidated financial statements and notes thereto included in Cisco's most recent reports on Forms 10-Q and 10-K as each may be amended from time to time. Cisco's results of operations for the three and nine months ended April 29, 2023 are not necessarily indicative of Cisco's operating results for any future periods. Any projections in this release are based on limited information currently available to Cisco, which is subject to change. Although any such projections and the factors influencing them will likely change, Cisco will not necessarily update the information, since Cisco will only provide guidance at certain points during the year. Such information speaks only as of the date of this release.

This release includes non-GAAP net income, non-GAAP gross margins, non-GAAP operating expenses, non-GAAP operating income and margin, non-GAAP effective tax rates, non-GAAP interest and other income (loss), net, and non-GAAP net income per share data for the periods presented. It also includes future estimated ranges for gross margin, operating margin, tax provision rate and EPS on a non-GAAP basis.

These non-GAAP measures are not in accordance with, or an alternative for, measures prepared in accordance with generally accepted accounting principles and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Cisco believes that non-GAAP measures have limitations in that they do not reflect all of the amounts associated with Cisco's results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate Cisco's results of operations in conjunction with the corresponding GAAP measures.

Cisco believes that the presentation of non-GAAP measures when shown in conjunction with the corresponding GAAP measures, provides useful information to investors and management regarding financial and business trends relating to its financial condition and its historical and projected results of operations.

For its internal budgeting process, Cisco's management uses financial statements that do not include, when applicable, share-based compensation expense, amortization of acquisition-related intangible assets, acquisition-related/divestiture costs, significant asset impairments and restructurings, significant litigation settlements and other contingencies, Russia-Ukraine war costs, gains and losses on investments, the income tax effects of the foregoing and significant tax matters. Cisco's management also uses the foregoing non-GAAP measures, in addition to the corresponding GAAP measures, in reviewing the financial results of Cisco. In prior periods, Cisco has excluded other items that it no longer excludes for purposes of its non-GAAP financial measures. From time to time in the future there may be other items that Cisco may exclude for purposes of its internal budgeting process and in reviewing its financial results. For additional information on the items excluded by Cisco from one or more of its non-GAAP financial measures, refer to the Form 8-K regarding this release furnished today to the Securities and Exchange Commission.

Annualized recurring revenue represents the annualized revenue run-rate of active subscriptions, term licenses, operating leases and maintenance contracts at the end of a reporting period, net of rebates to customers and partners as well as certain other revenue adjustments. Includes both revenue recognized ratably as well as upfront on an annualized basis.

About Cisco

Cisco (Nasdaq: CSCO) is the worldwide leader in technology that powers the Internet. Cisco inspires new possibilities by reimagining your applications, securing your data, transforming your infrastructure, and empowering your teams for a global and inclusive future. Discover more at The Newsroom and follow us on Twitter at @Cisco.

Copyright © 2023 Cisco and/or its affiliates. All rights reserved. Cisco and the Cisco logo are trademarks or registered trademarks of Cisco and/or its affiliates in the U.S. and other countries. To view a list of Cisco trademarks, go to: www.cisco.com/go/trademarks. Third-party trademarks mentioned in this document are the property of their respective owners. The use of the word partner does not imply a partnership relationship between Cisco and any other company. This document is Cisco Public Information.

RSS Feed for Cisco: https://newsroom.cisco.com/rss-feeds